OTC Crypto – A Niche of the Financial Markets That Caters to Big Investors and Traders

OTC Crypto

The OTC crypto market is a niche of the financial world that primarily caters to big investors and traders. Many of the largest deals in the OTC crypto market are opaque to outsiders. Having access to these deals has allowed me to see how cultural differences affect the relationship between buyers and sellers. In the case of large crypto buyers, many of these buyers come from wealthy families or exchanges. For those who are not familiar with these types of transactions, I recommend doing a Google search to see if the attorney or brokerage firm you’re dealing with is involved in any OTC deals.

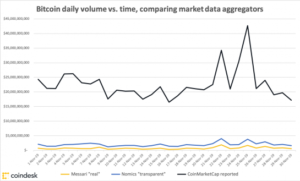

The OTC crypto market is huge – around $10 billion USD is traded daily. However, it is difficult to verify the volume level and profit margins of the participants. However, it is possible to identify the major players based on their history, reputation and range of services. Circle Trade, for example, is a global player that offers over 30 different crypto assets and can settle transactions in most major fiat currencies. This makes it an excellent choice for traders looking to invest in the OTC market.

Decentralized OTC crypto exchange

The OTC crypto market works in a similar way to the over-the-counter drug market. There is no centralized exchange to regulate the trades. The trades are made directly between buyers and sellers. This eliminates the need for an external mediator. However, there are some differences between lit pools and dark pools. For example, the former features an order book that allows investors to see bids and offers, while the latter does not.

OTC Crypto – A Niche of the Financial Markets That Caters to Big Investors and Traders

The OTC crypto market works on a decentralized system. It allows transactions to take place directly between buyers and sellers, preventing problems associated with traditional cryptocurrency exchanges. In addition to this, OTC trading allows traders to trade a larger amount of cryptocurrency than the exchange platform does. A typical OTC transaction will take place over a period of a few hours. The OTC market also tends to be more transparent, making the transactions more convenient and reliable.

An analysis by the TABB Group shows that the OTC crypto ecosystem is three times larger than the open exchange market. According to the company Kraken, the volume of daily trades on the OTC market has increased by almost twenty-fold since early 2018. Combined crypto exchanges report that there are 140 billion dollars traded every day on exchanges. This means that the OTC market is now making up about 70% of the total volume of the crypto market.

A significant drawback of retail crypto exchanges is limited liquidity. Currently, Bitcoin, ethereum, and tether account for nearly $72 billion in total trade volume. The liquidity in each platform directly affects the volume available per trade. This is particularly true for tokenised assets that are linked to physical properties. While retail exchanges are relatively stable, their liquidity is not. Therefore, illiquid markets make the OTC market a better option for investors looking to diversify their crypto portfolio.